Fortify your family's future with Aura identity protection

- Comprehensive identity protection

- Transparent and affordable pricing

- Family-focused security plans

Why Identity Protection Matters

In today’s digital world, identity theft is more prevalent than ever. In 2023 alone, over $10 billion was lost to identity theft and fraud in the U.S. Protecting your family’s financial future requires more than just savings—it demands proactive measures to secure your personal information.

have a plan

The Threat of Identity Theft,

is what Aura plans are designed to combat. With 1 out of 3 people experiencing identity theft, ensuring your family’s security is more important than ever. Identity theft isn’t just about stolen credit card information—it can impact your entire financial well-being, including your children’s future.

Exclusive Benefits With Aura

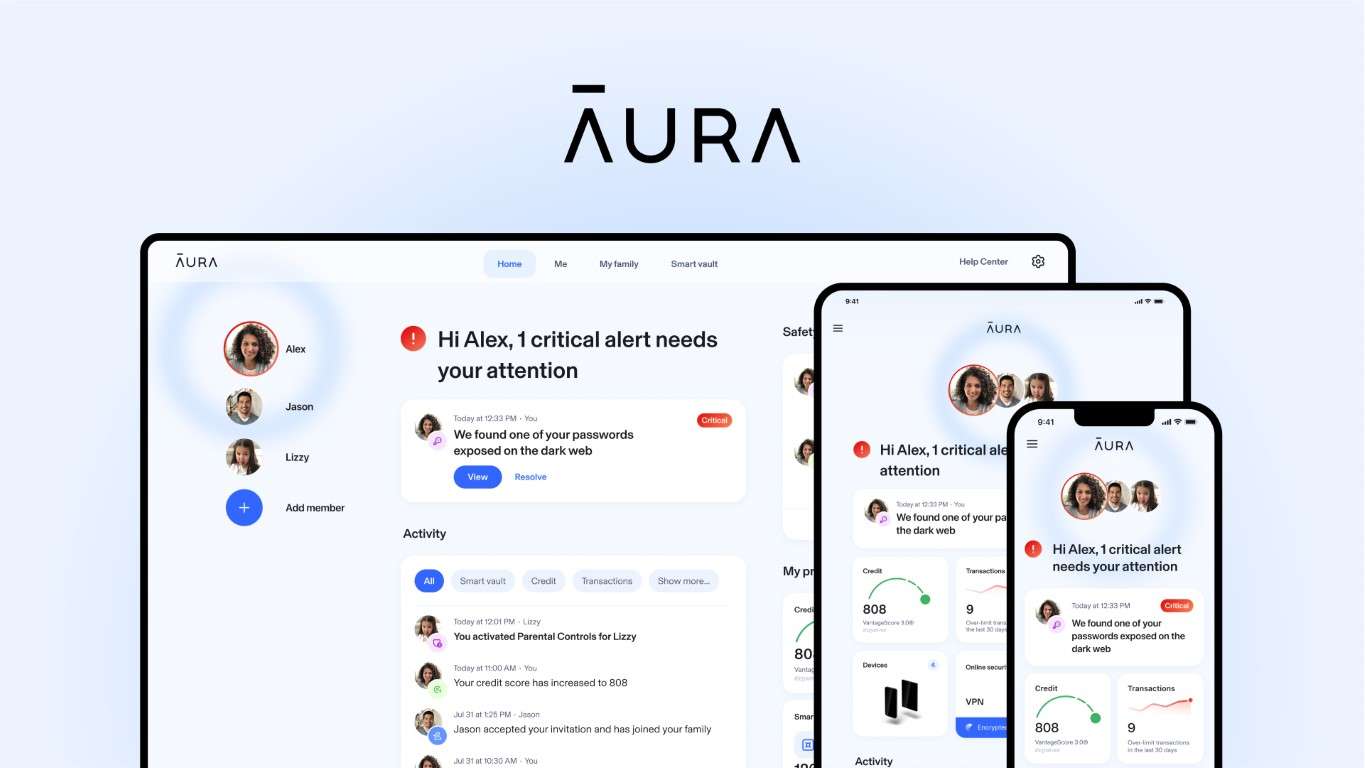

Better Protection

5 adults and unlimited kids are protected across all 3 credit bureaus

Always Everywhere

Up to 250x faster fraud alerts, VPN, password manager, antivirus, and more

Covered Losses

$1 million of coverage to replace eligible losses due to identity theft

Support At Home

Support specialist based in the United States to handle your questions, claims, and calls

Risk Free

Try Aura with confidence—if you’re not completely satisfied, Aura offers a 60-day money-back guarantee.

A Partnership You Can Trust

As part of the UNest family, Aura identity protection shares our commitment to helping families achieve financial security. Together, we offer comprehensive financial solutions designed to build a brighter future for your loved ones.

UNest

The most trusted platform for busy parents who care about the future.

Aura

The most comprehensive online protection so what you grow stays safe.

Setup is Quick and Easy

- Sign Up: Choose the plan that’s right for your family.

- Activate Protection: Follow the simple setup instructions.

- Stay Informed: Relax until a proactive alert of potential threats.

Ready to get started?

It starts with the UNest app. Open an account in minutes and you’re on your way to safeguarding

your kid’s financial future.

Invest

Prepare for your child’s future college, wedding, car, whatever – by investing regularly.