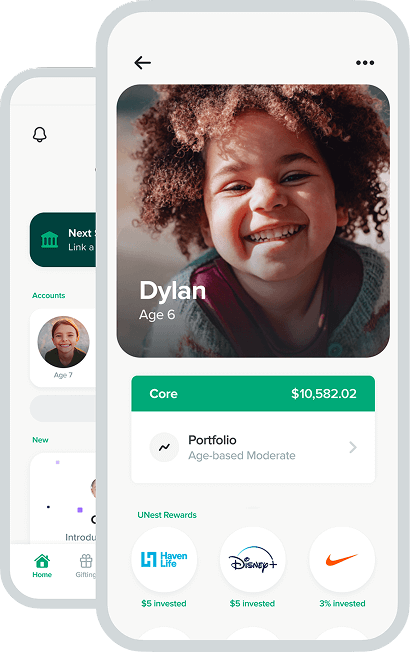

Family investing made easy

Build a brighter future for your kids. Join the growing community of parents that save and invest with UNest.

Get StartedAS SEEN IN

UNest is the market leader in tax-advantaged custodial investment accounts* for kids.

* Investment advisory services offered through UNest Advisers, LLC, an SEC-registered investment adviser.

One Year Free

No fees on balances up to $300 for the first 12 months

What’s better than watching your kid’s money grow?Watching it grow for free.

after your first year or $300+ balance

$2/mo + 0.25% annual

no surprises

Rewards

Hundreds of brands are waiting to invest in your kid’s future for making purchases you would make anyway.

Gifting

Invite your friends and family to invest alongside you in your kid’s financial future.

Protection

Give your family more than just a head start — give them financial security.

Term life insurance through

4.7 star app store rating

UNest Savings Calculator

Adjust the numbers to explore how your savings could add up.

Hear from our brand ambassadors

Tap a card to discover their story

For all you parents out there, do well by your children. Y'all can save! UNest!

Montell Jordan

Grammy-Nominated Artist

Watch

Tap to flip back

This is how we UNest

Montell Jordan

Tap for more

I have four kids, and their future matters. Saving and investing should not be complicated. UNest removes the friction that turns good intentions into unfinished projects. I wish this had existed earlier in my life.

Brent Celek

Superbowl Champion

Tap to flip back

UNest makes investing easy

Brent Celek

Tap for more

As a father of two young boys, I care about their financial future and I know that other parents are feeling the same way. By making it easy for parents to step into saving plans, UNest is going to transform the future of the next generation.

Baron Davis

NBA All-Star

Tap to flip back

Transforming the financial future of the next generation

Baron Davis

Tap for more