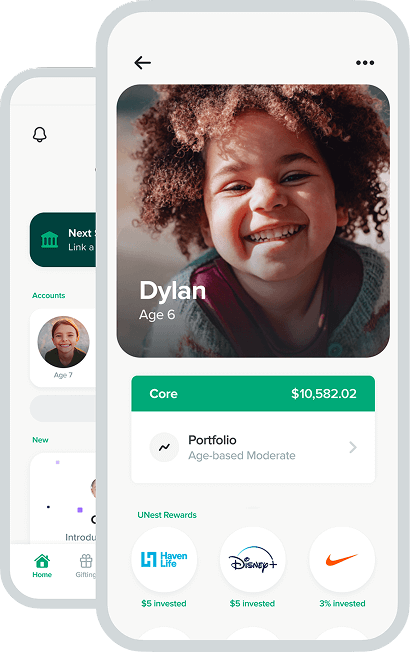

Family investing made easy

Build a brighter future for your kids. Join the growing community of parents that save and invest with UNest.

Get StartedAS SEEN IN

UNest is the market leader in tax-advantaged custodial investment accounts* for kids.

* Investment advisory services offered through UNest Advisers, LLC, an SEC-registered investment adviser.

One Year Free

No fees on balances up to $300 for the first 12 months

What’s better than watching your kid’s money grow?Watching it grow for free.

after your first year or $300+ balance

$2/mo + 0.25% annual

no surprises

Rewards

Hundreds of brands are waiting to invest in your kid’s future for making purchases you would make anyway.

Gifting

Invite your friends and family to invest alongside you in your kid’s financial future.

Protection

Give your family more than just a head start — give them financial security.

Term life insurance through

4.7 star app store rating

UNest Savings Calculator

Adjust the numbers to explore how your savings could add up.