Parents prioritize saving for their children over saving for retirement, paying off a mortgage, taking a vacation, and paying off their own student debt. There is some interesting stats in the survey.

Full Press Release:

U-Nest, the first and only mobile app to help families build, manage, and optimize a tax-free college savings plan, today released the results of their inaugural survey on parents’ attitudes, concerns, and preferences for saving for their children’s college education.

Overall Findings:

- Parents prioritize saving for their children over saving for retirement, paying off a mortgage, taking a vacation, and paying off their own student debt.

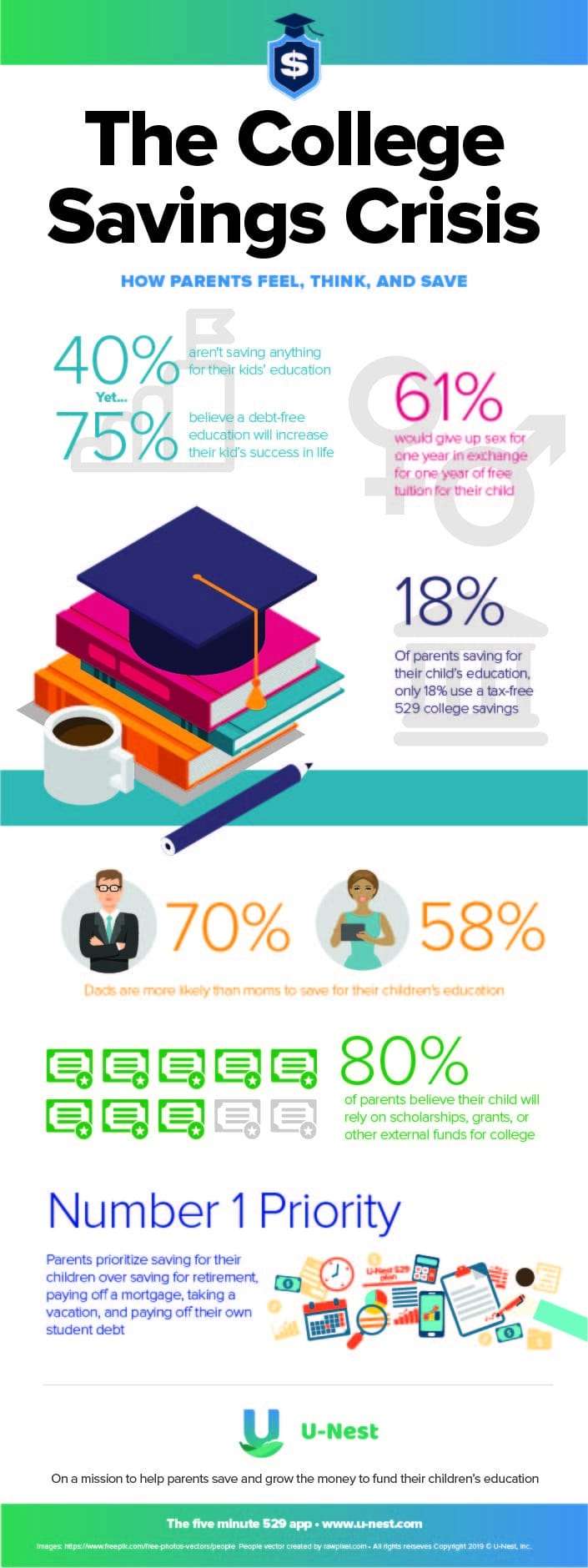

- While 75 percent of parents believe a debt-free college education will increase their kid’s chances for success in life, nearly 40 percent aren’t saving anything for their kids’ education.

- Meanwhile, only 20 percent of parents believe their child will NOT need to rely on scholarships, grants, or other external sources of funds for college.

- Of the parents who are saving for their child’s education, the majority are using a checking or savings account, and only 18 percent are using a tax-free 529 college savings plan. For younger parents (ages 18-35), just 13 percent are taking advantage of saving with a 529 Plan.

- More than 40 percent of parents age 18-35 are currently paying off student loans, and most parents (61 percent) wish their own parents would have saved more for their education.

- All of this is leading to parents willing to sacrifice their own needs, with over 60 percent stating they would give up sex for one year in exchange for one year of of free college tuition for their kids.

“We all know saving for college is hard – it’s a huge expense, which is why student debt is out of control (currently at $1.5 trillion) and still growing. This data shows how extreme the problem has become,” said Ksenia Yudina, Founder and CEO of U-Nest. “The fact that parents are willing to sacrifice their own well-being to reduce the cost of college puts into perspective how large this crisis is, and the toll it’s taking on families across the country.”

Parents know saving is important, but don’t have the knowledge or expertise to get started. U-Nest’s study found that parents prioritize saving for their children over saving for retirement, paying off a mortgage, taking a vacation, and paying off their own student debt.

- For men, saving for their children is their number one priority, while women prioritize saving for an emergency fund. Both genders prioritize saving for their children higher than saving for retirement.

- The majority of parents (67 percent) don’t have a financial planner or wealth manager to help them plan money matters, which helps explain why 70 percent of Americans haven’t heard of a 529 Plan, the tax-advantaged savings plan that experts agree is the best investment vehicle to save for college.

Financial habits differ between the sexes and take a toll on relationships.

Money is the number one reason parents argue with their partner (above family dynamics, kids, division of labor, and love life).

- 63 percent of dads believe overspending on expensive and unnecessary toys and other products affect their ability to save for their kids’ education (vs. only 49 percent of moms).

- More men claim to make the household financial decisions than women (40 percent vs. 32 percent respectively).

- Dads are more likely than moms to save for their children’s education (70.1 percent vs. 58.2 percent respectively).

- Nearly two-thirds (64.7 percent) of moms age 18-34 are afraid they’re not saving enough for their kids’ college, compared to half (51.7 percent) of moms over 34.

- Moms are more likely to say they don’t let money issues impact the way they parent (69 percent of moms vs. 50 percent of dads).

Whether parents are saving for college or not, they’re worried about the future.

More than half (56 percent) of parents are worried they’re not saving enough for their child’s education.

- Of the parents that are currently saving for college, 35 percent feel they still are not saving enough.

- Eighty-three percent of parents that are not saving for college still feel they should pay for at least some of their child’s college education; 47 percent expect their children to need grants/scholarships or other external sources of funding.

“Like so many people across the country, I wasn’t prepared for the cost of my education. I graduated with over $150,000 in student loans and was determined to make sure my kids didn’t suffer the same future,” said Yudina. “I created U-Nest to help the millions of American parents who also want to give their children a great education without the burden of crushing student debt.”

U-Nest is the first digital financial advisor to simplify and democratize saving for college with a 529 Plan. In as little as five minutes, parents can establish a 529 Plan through U-Nest, set monthly contributions, track their progress, and easily adjust contributions over time, all from their phones.

U-Nest financial experts optimize plans to ensure money is invested in the smartest way possible based on the plans available, the child’s age, and the parents’ contribution level. Unlike financial advisors that cost upwards of $200 per hour and have complex underlying fee structures that add up to hundreds of dollars in annual broker-dealer commissions, U-Nest’s advisory fee is a simple and transparent $3/ month.

To open a U-Nest account, visit //unest.co/ or download on iTunes.

Methodology

This survey was conducted by independent research firm Survata on behalf of U-Nest. Survata interviewed 506 U.S. adult parents over the age of 18 between February 4-15, 2019. Complete findings of the survey are available upon request.

About U-Nest

U-Nest is on a mission to help all parents simply and smartly save and grow the money needed to fund their children’s education. With an easy-to-use mobile app that in minutes establishes and manages a 529 College Savings Plan, U-Nest gives families the tools they need to fund a comprehensive education savings plan so their children are free to pursue the education they deserve without being saddled with crushing student loans. The U-Nest team has decades of experience as certified financial advisors, fintech technologists, and entrepreneurs.

The company is based in Los Angeles, CA. To find out more and get started, visit //unest.co/.

Click on our link to learn more.

This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own financial, legal, and tax advisors before engaging in any transaction. Information, including hypothetical projections of finances, may not take into account taxes, commissions, or other factors which may significantly affect potential outcomes. This material should not be considered an offer or recommendation to buy or sell a security. While information and sources are believed to be accurate, UNest does not guarantee the accuracy or completeness of any information or source provided herein and is under no obligation to update this information.