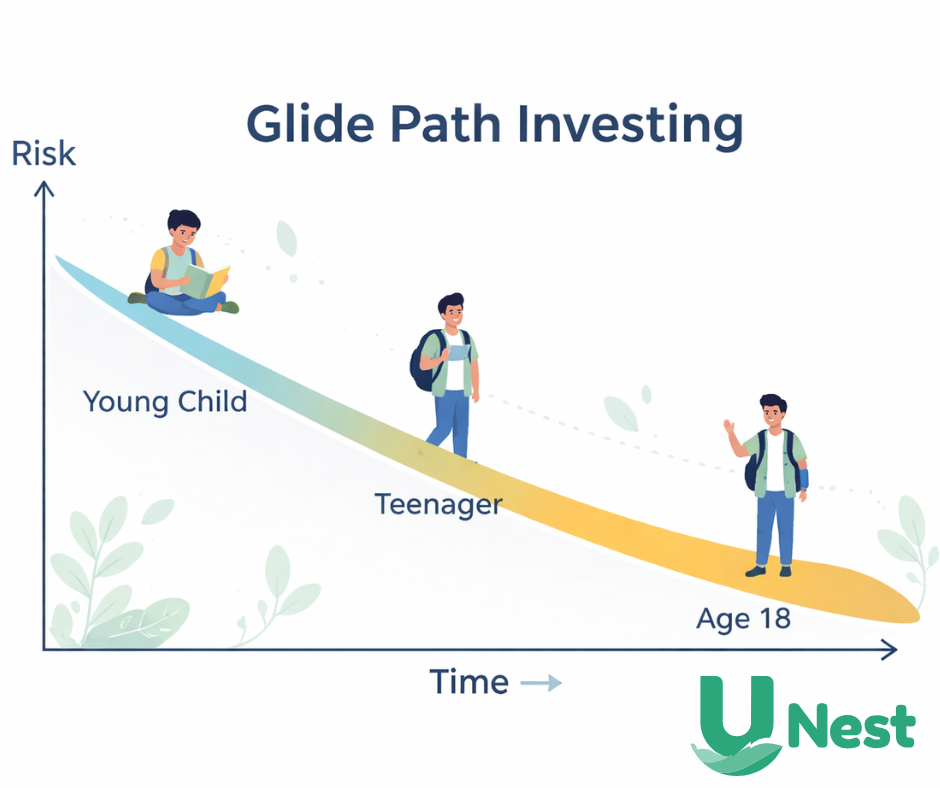

Understanding Risk Tolerance When Investing for Kids

When people think about risk tolerance, they often associate it with retirement planning or adult investing decisions.In reality, risk tolerance plays an important role when investing for children as well.…