When parents think about investing for their children, the focus is often on growth. Starting early, investing consistently, and letting time do the work all matter.

But growth is only part of the picture.

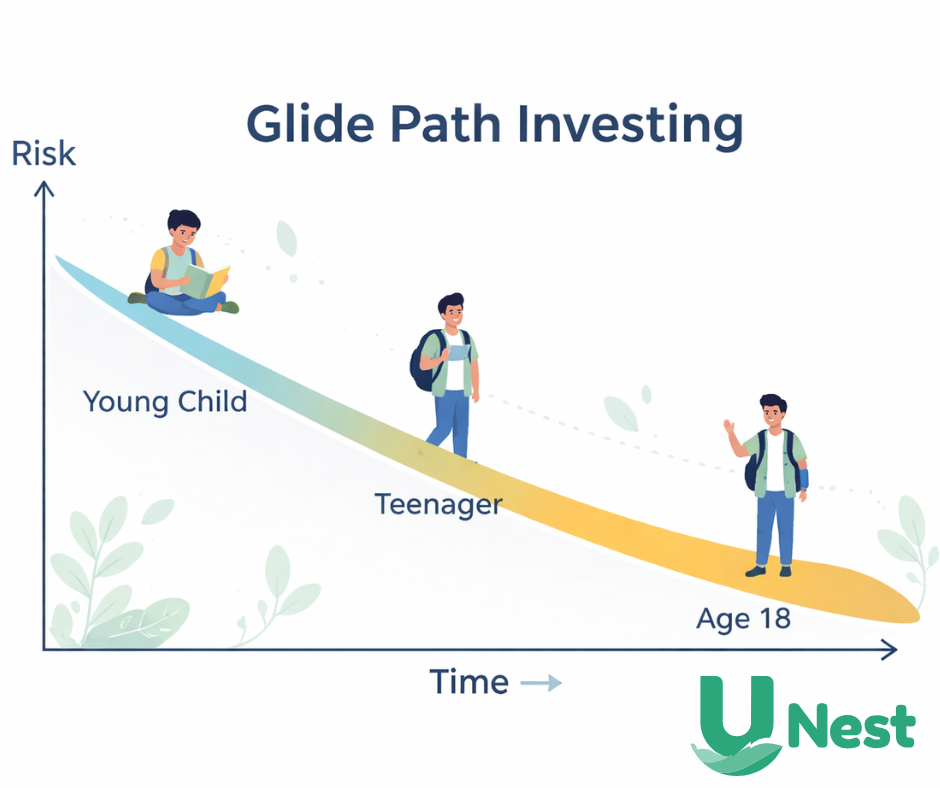

As children get older and move closer to adulthood, managing risk becomes just as important as pursuing returns. That is where glide path investing comes in.

What a Glide Path Means in Investing

In investing, a glide path refers to how an investment portfolio gradually shifts over time to reduce risk. Early on, portfolios tend to hold more growth-oriented investments. As a target date approaches, the portfolio slowly becomes more conservative.

According to Investopedia’s definition of a glide path, this approach is designed to balance growth and stability by adjusting asset allocation as time horizons change.

Glide paths are commonly used in retirement planning, but the concept applies just as well to long-term investing for children.

Why Glide Pathing Makes Sense for Kids

When a child is young, time is on their side. Market ups and downs matter less because there is a long runway ahead. This allows portfolios to take on more risk in pursuit of long-term growth.

As children approach the age of majority, that timeline shortens. Funds may soon be used for education, housing, or early adult expenses. At that point, protecting what has been built becomes more important.

The Corporate Finance Institute explains that glide paths are designed to systematically reduce risk over time, rather than reacting emotionally to market conditions. This structure helps avoid sudden shifts or last-minute decisions that can increase risk at the wrong time.

For families, this creates a smoother transition from growth-focused investing to preservation-focused planning.

How Glide Pathing Supports Real Life Transitions

Life does not change overnight, and investing strategies should not either.

A glide path approach recognizes that financial needs evolve gradually. By adjusting risk over time, portfolios can better align with upcoming milestones instead of forcing families to time the market.

This can be especially helpful for parents who want a disciplined strategy that adapts automatically as their child grows. Rather than guessing when to change allocations, the glide path provides a clear framework.

It also helps reduce stress. Knowing that risk is being managed intentionally can give parents confidence, even during market volatility.

How UNest Uses Glide Pathing

UNest applies glide pathing to help decrease investment risk as a child approaches the age of majority.

Early in a child’s life, portfolios are positioned to focus more on long-term growth. As the child gets older, the investment mix gradually shifts to become more conservative. This helps protect accumulated value as funds move closer to being used.

The goal is not to eliminate risk entirely, but to align risk with timing. That way, families are not forced into abrupt changes when the child reaches adulthood.

Planning With Confidence Over Time

Glide path investing is about preparation, not prediction.

By adjusting risk gradually and thoughtfully, families can focus less on short-term market movements and more on long-term goals. It supports steady progress while recognizing that timelines matter.

You do not need to be perfect to invest well. Starting early, staying consistent, and letting the strategy adapt over time can make a meaningful difference.

Getting Started

Investing for a child’s future is a long-term commitment, and having a strategy that evolves alongside them can provide peace of mind.

For families looking for an approach that balances growth early on and risk management later, UNest’s glide path investing model is designed to support that journey.