LATEST POSTS

Why Every Family Needs a Financial Plan

A family financial plan reduces stress, keeps spending in check, and aligns daily decisions with long-term goals. Here's how to start.

Continue Reading →

Gen Z Parenting In A Social Media World

Parenting has always reflected the world families live in. For Gen Z parents, that world is shaped by social media, constant connectivity, and growing...

Continue Reading →

Teaching Teens Financial Literacy With Real Tips That Work

Teenagers are closer to financial independence than many parents realize. Part-time jobs, online spending, peer pressure, and digital payments all show up...

Continue Reading →

Understanding Risk Tolerance When Investing for Kids

When people think about risk tolerance, they often associate it with retirement planning or adult investing decisions.

Continue Reading →

Parenthood And The Middle Class Crunch

For many families today, the math feels harder than it used to.

Continue Reading →

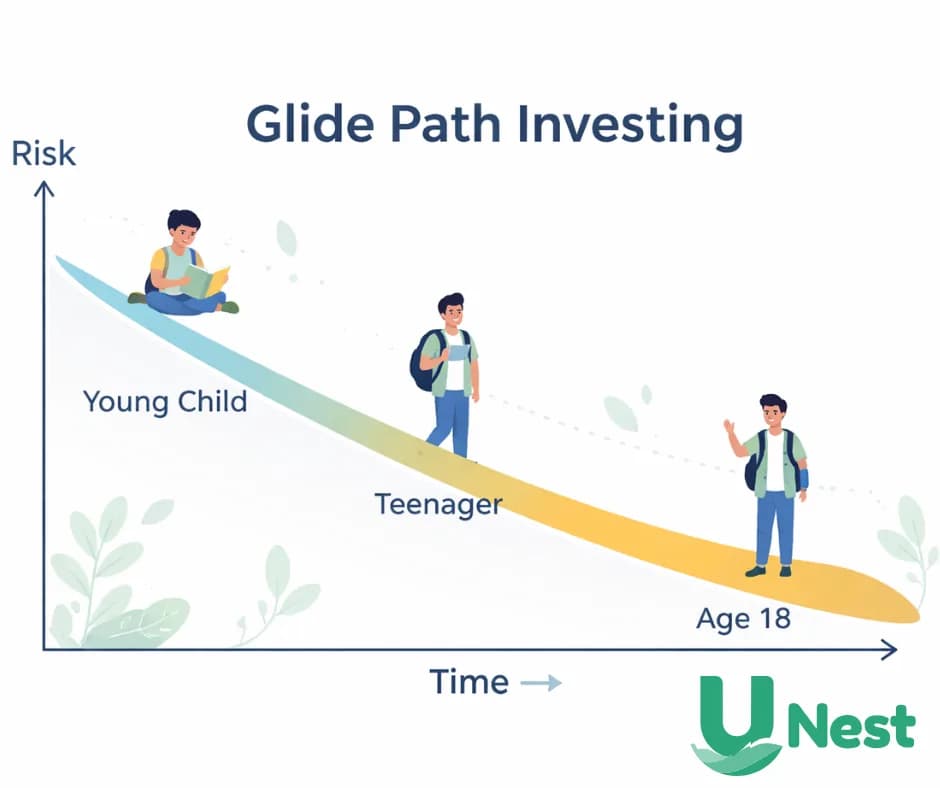

What Is a Glide Path And Why It Matters for Kids Investing

When parents think about investing for their children, the focus is often on growth.

Continue Reading →

Why Parenthood Still Makes Sense During the Middle Class Crunch

Learn about why parenthood still makes sense during the middle class crunch and how it can help your family's financial future.

Continue Reading →

How to Teach Kids Money Skills That Actually Stick

Teaching kids about money has always mattered, but today it feels more urgent than ever.

Continue Reading →

Why ETFs Make Sense for Long-Term Investing

When it comes to investing for your child's future, simplicity and consistency often beat complexity and timing.

Continue Reading →

More Dads Are Staying Home with the Kids - Here's Why Financial Planning Matters

The modern family is evolving. A growing number of dads are stepping into full-time caregiver roles, reflecting a significant cultural shift.

Continue Reading →

Preparing for the Future: 2026 Trends in K-12 Innovation Every Parent Should Know

The Consortium for School Networking (CoSN) recently outlined the top issues shaping the future of education in 2026.

Continue Reading →

Teaching Kids the Difference Between Investing and Gambling

In today's digital world, the lines between investing, gaming, and gambling are getting blurrier - especially for teens.

Continue Reading →

The Power of Dollar Cost Averaging: Why Consistency Wins in the Long Run

Dollar cost averaging removes emotion from investing. Consistent contributions build wealth regardless of market swings.

Continue Reading →Don’t just take our word for it

Hear what trusted money experts say about why UTMA and UGMA accounts can be a smart way to invest for a child’s future.

Investing for your kid’s future

Dave Ramsey

Personal Finance Expert

Tap for more

There are some tax advantages to using UGMA and UTMA accounts… Since they’re in your child’s name, the accounts will be taxed according to their tax bracket… There are no contribution limits on UGMA and UTMA accounts.

Dave Ramsey

Personal Finance Expert

Read

Tap to flip back

Straightforward “starter” investing account for kids

Jill Schlesinger

Emmy winning Business Analyst

Tap for more

…you could consider opening an account where you can dive deeper with the kids by your side. The easiest way to do so is to open a custodial account, known as an UGMA … or UTMA … account.

Jill Schlesinger

Emmy winning Business Analyst

Read

Tap to flip back

Give children money that can accumulate over time

Jim Cramer

CNBC Host

Tap for more

You can give children money that can accumulate somewhat tax-free over time... I love them (UTMAs) because they were like, trusts that you didn’t need lawyers to create.... I think it’s one of the better tax breaks around though. I know hunting for tax breaks may not sound very exciting, but that’s how you take care of your family.

Jim Cramer

CNBC Host

Watch

Tap to flip back